Honesty Matters in Hurricane Insurance Claims

After a devastating hurricane, homeowners often face property damage, financial stress, and complicated insurance claims. During this difficult time, guidance from a hurricane attorney can make a meaningful difference.

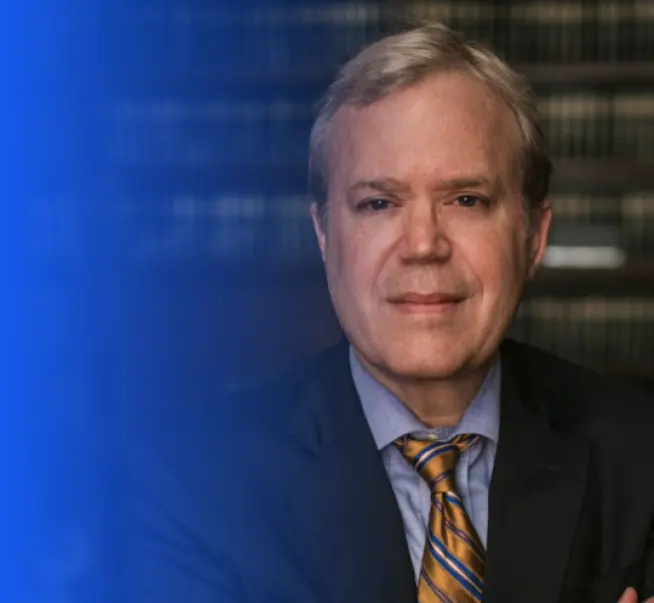

At Cueria Law Injury Lawyers, we regularly help homeowners navigate hurricane insurance claims. One issue we stress repeatedly is simple but critical: honesty matters. Being truthful throughout the claims process protects your rights and your recovery.

Below, we explain how hurricane insurance works, what coverage may apply, and why accuracy is essential when filing a claim.

Understanding Hurricane Insurance Coverage

Insurance companies do not sell a single, standalone “hurricane insurance” policy. Instead, homeowners rely on a combination of policies to cover hurricane-related damage.

Typically, coverage comes from:

-

A standard homeowners insurance policy

-

Flood insurance, purchased separately

Together, these policies may cover wind damage, personal property losses, and temporary living expenses.

Key Points to Know

-

Homeowners insurance does not cover all hurricane damage

-

Flood insurance is required for storm surge and flooding

-

Hurricane claims often carry higher deductibles

-

Policy changes may be restricted once a storm approaches

Because of these limits, reviewing coverage before hurricane season begins is especially important.

Types of Hurricane Insurance Coverage

Dwelling Coverage

Dwelling coverage protects the structure of your home, including attached features and built-in appliances. Most homeowners insure this portion for the full rebuild cost of the home.

Other Structures Coverage

This coverage applies to detached structures such as garages or sheds. In most policies, it equals about 10% of the dwelling coverage limit.

Personal Property Coverage

Personal property coverage protects belongings inside your home. It often equals 50% to 70% of the insured value of the house.

Additional Living Expenses (ALE)

If a covered hurricane loss forces you to leave your home, ALE coverage helps pay for temporary housing, meals, and related costs.

Hurricane Deductibles Explained

Hurricane or wind damage claims usually involve a separate deductible. This deductible often ranges from 1% to 5% of your dwelling coverage, which can result in a significant out-of-pocket cost.

Understanding this deductible before a storm hits can prevent surprises later.

Additional Coverage Options to Consider

Flood Insurance

Flood insurance is essential because homeowners insurance does not cover flood damage. Homeowners can obtain coverage through the National Flood Insurance Program (NFIP) or private insurers.

Windstorm Insurance

In high-risk areas, windstorm coverage may be required. This protection may exist as an endorsement or a standalone policy.

Water Backup Coverage

This optional coverage protects against damage caused by sewer or drain backups.

Debris Removal Coverage

Debris removal coverage helps pay for clearing fallen trees and other storm debris from your property.

How to Prepare for a Hurricane Insurance Claim

Preparation can make the claims process much smoother. Before a storm:

-

Take photos and videos of your home’s interior and exterior

-

Document renovations, upgrades, and valuable items

After the storm:

-

Photograph all damage immediately

-

Keep repair estimates and receipts

Clear documentation strengthens your claim and reduces delays.

The Consequences of Dishonesty in Hurricane Claims

Providing false or exaggerated information on a hurricane insurance claim can lead to serious consequences. Insurance fraud may result in:

-

Claim denial

-

Policy cancellation

-

Higher premiums

-

Civil penalties or criminal charges

For this reason, accuracy and transparency remain the safest approach. Supporting your claim with documentation protects both your coverage and your credibility.

Hurricane Coverage for Renters and Condo Owners

Hurricane insurance also matters for renters and condo owners.

-

Renters need coverage for personal belongings and living expenses

-

Condo owners must understand what their association covers and what they must insure themselves

Reviewing these details before hurricane season can prevent costly gaps in coverage.

Frequently Asked Questions

Is there standalone hurricane insurance?

No. Coverage comes from homeowners, flood, and optional policies.

What is a hurricane moratorium?

A moratorium temporarily prevents policy changes when a storm threatens.

Does car insurance cover hurricane damage?

Comprehensive auto coverage may cover storm-related vehicle damage.

How much does flood insurance cost?

Costs vary based on location, elevation, and risk level.

Get Help With a Hurricane Insurance Claim

Filing a hurricane insurance claim can feel overwhelming. Legal guidance helps ensure accuracy, compliance, and fair treatment.

At Cueria Law Injury Lawyers, we help homeowners understand coverage, avoid costly mistakes, and protect their recovery. If you need assistance with a hurricane insurance claim, feel free to contact us.