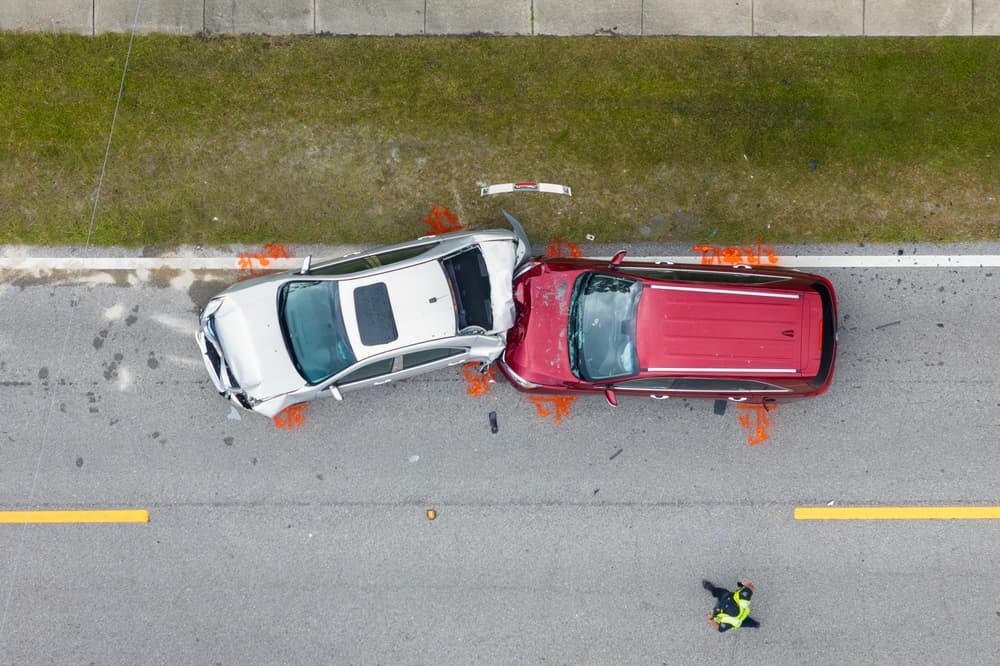

Car accidents are an unfortunate reality for many people in Louisiana. In the blink of an eye, a collision can leave you facing physical injuries, emotional trauma, and financial burdens. One way to protect yourself from these potential hardships is through Uninsured/Underinsured Motorist (UM) Insurance. In this article, we will explore the importance of UM Insurance in Louisiana, how it works, and how it can help you after a car accident. We will also discuss the role of a New Orleans Personal Injury Attorney in UM claims, common challenges in UM Insurance claims, and tips for maximizing the benefits of your UM Insurance policy.

Introduction to UM Insurance in Louisiana

Louisiana is a state with a high rate of car accidents, and many drivers are either uninsured or underinsured. To help protect its citizens, the state requires all drivers to carry a minimum amount of UM Insurance coverage. While this mandatory coverage can provide some financial relief in the event of an accident with an uninsured or underinsured driver, it is often not enough to cover all the expenses and losses that can arise from a serious collision.

UM Insurance is designed to provide additional coverage in situations where the at-fault driver’s insurance is insufficient or non-existent. In this way, UM Insurance helps to protect you from the financial burden of an accident caused by another driver who lacks adequate coverage.

Understanding UM Insurance: What is it?

Uninsured/Underinsured Motorist (UM) Insurance is a type of auto insurance coverage that protects policyholders in the event they are involved in a car accident with a driver who has no insurance or an insufficient amount of insurance coverage. This can be crucial in helping to cover the costs associated with medical expenses, lost wages, and other damages resulting from the accident.

In Louisiana, UM Insurance is split into two categories: Uninsured Motorist Bodily Injury (UMBI) coverage and Underinsured Motorist Property Damage (UMPD) coverage. UMBI provides coverage for injuries sustained by you or your passengers, while UMPD covers damage to your vehicle and other property.

Why UM Insurance is crucial after a car accident

UM Insurance is essential for several reasons. First and foremost, it provides financial protection for accident victims when the at-fault driver does not have insurance or has inadequate coverage. In such cases, without UM Insurance, victims may be left to bear the brunt of the financial burden themselves.

Additionally, UM Insurance can help cover the costs of medical treatment, lost wages, and other damages that may not be fully covered by the at-fault driver’s insurance. This can be especially important if you or your passengers suffer serious injuries that require ongoing care or cause long-term disability.

Finally, having UM Insurance can provide peace of mind in knowing that you are protected in the event of an accident with an uninsured or underinsured driver. This can help alleviate some of the stress and anxiety that often accompany car accidents and their aftermath.

Statutory requirements for UM coverage in Louisiana

Under Louisiana law, every auto insurance policy must include UM Insurance coverage. Policyholders are required to carry a minimum amount of coverage, which is equal to the state’s minimum liability coverage limits. As of 2021, these limits are:

- $15,000 per person for bodily injury

- $30,000 per accident for bodily injury

- $25,000 per accident for property damage

These minimum amounts may not be sufficient to cover all the expenses and damages that can result from a car accident. Therefore, policyholders have the option to purchase additional UM Insurance coverage beyond the state-required minimums.

It is important to note that Louisiana law allows policyholders to reject UM Insurance coverage in writing. However, given the benefits and protection that UM Insurance provides, it is generally not recommended to waive this coverage.

How UM Insurance protects you financially

UM Insurance can play a vital role in protecting you financially after a car accident. It can help to cover the costs associated with medical treatment, lost wages, and other damages that may not be fully covered by the at-fault driver’s insurance. In cases where the at-fault driver has no insurance or insufficient coverage, UM Insurance can help ensure that you are not left to bear the full financial burden of the accident.

Additionally, UM Insurance can also protect you in the event of a hit-and-run accident, where the at-fault driver flees the scene and cannot be identified.

Filing a UM Insurance claim after a car accident

If you are involved in a car accident with an uninsured or underinsured driver, it is important to follow certain steps to ensure that you can successfully file a UM Insurance claim. These steps include:

- Notify the police: Always call the police to report the accident, even if the at-fault driver has no insurance or is underinsured. The police report can be crucial in proving your claim later on.

- Gather evidence: Collect as much information as possible at the scene of the accident. This includes taking photos of the damage to your vehicle and any injuries you sustained, as well as obtaining contact information from witnesses.

- Notify your insurance company: Inform your insurer of the accident as soon as possible and provide them with all the necessary information and evidence to support your claim.

- Seek medical treatment: Even if you feel fine immediately after the accident, it is important to seek medical treatment to document any injuries and ensure that you receive the appropriate care.

- Consult with a New Orleans Personal Injury Attorney: An experienced attorney can help guide you through the UM Insurance claim process and ensure that you receive the maximum benefits available under your policy.

The role of a New Orleans Personal Injury Attorney in UM claims

Navigating the UM Insurance claims process can be complex and challenging, especially if you have suffered serious injuries or significant property damage. This is where a New Orleans Personal Injury Attorney can be invaluable.

An experienced attorney can help ensure that your rights are protected, help you gather the evidence needed to support your claim, and negotiate with the insurance company to secure a fair settlement. They can also guide you through the legal process if your claim is denied or if the insurance company fails to provide an adequate settlement.

Ultimately, having a skilled attorney by your side can help maximize the benefits available under your UM Insurance policy and ensure that you receive the compensation you deserve.

The role of a New Orleans Personal Injury Attorney in UM claims

While UM Insurance can provide critical protection after a car accident, filing a claim is not always straightforward. Some common challenges that may arise during the claims process include:

- Disputes over fault: The insurance company may try to shift the blame for the accident onto you or argue that the other driver was not at fault.

- Lack of evidence: If you do not have sufficient evidence to support your claim, such as witness statements or medical records, the insurance company may deny your claim.

- Lowball settlements: The insurance company may offer you a settlement that does not fully cover your expenses and losses related to the accident.

- Denial of coverage: In some cases, the insurance company may deny your claim altogether, leaving you to bear the financial burden of the accident.

Tips for maximizing the benefits of your UM Insurance policy

To help ensure that you receive the maximum benefits available under your UM Insurance policy, consider taking the following steps:

- Purchase additional coverage: The state-required minimums may not be enough to cover all the expenses and losses that can result from a serious car accident. Consider purchasing additional UM Insurance coverage to provide added protection.

- Keep detailed records: Document all expenses and losses related to the accident, including medical bills, lost wages, and property damage. This can help support your claim and ensure that you receive the compensation you deserve.

- Seek medical treatment promptly: Even if you do not feel injured immediately after the accident, seek medical treatment as soon as possible. This can help document any injuries you sustained and ensure that you receive the appropriate care.

- Consult with an attorney: An experienced New Orleans Personal Injury Attorney can help guide you through the claims process and ensure that you receive the maximum benefits available under your policy.

Conclusion: Safeguarding your future with UM Insurance

Car accidents can be devastating, both physically and financially. Uninsured/Underinsured Motorist (UM) Insurance can help protect you from the financial burden of an accident caused by another driver who lacks adequate coverage.

By understanding the importance of UM Insurance, knowing your rights, and seeking the guidance of an experienced New Orleans Personal Injury Attorney, you can help safeguard your future and ensure that you receive the compensation you deserve after a car accident. So don’t wait until it’s too late – invest in UM Insurance today and enjoy the peace of mind that comes with knowing you are protected.